Partners

Finsight Global has entered into strategic partnerships with market-leading firms to provide our clients with cutting-edge solutions, advisory, and products in specialized areas.

Payment and Merchant advisory, Cross-border payment solutions, Enterprise Workflow solutions, development of Metaverse strategy & presence, Intelligent process automation technology, Enterprise application development, and Content management platform etc.

Payments Consulting Network has been providing strategic advisory and market research services to the financial services...

- Payments Consulting Network has been providing strategic advisory and market research services to the financial services and payments sectors since 2013. Our consulting network has presence in Asia-Pacific, North America, Europe and Africa.

- Areas of industry focus include merchant acquiring and online payments; ATM acquiring and deployment; card issuing; real-time payments; mobile payments; and the infrastructure that supports payments processing.

- Payments consulting services include strategy development, market research, business cases, market assessments, benchmarking, pricing tools, RFP/RFI support, fraud/risk frameworks, industry round tables, market entry support, technical advisory, training, and government relations.

- The firm established Merchant Advisory to support organisations in the retail, hospitality, tourism, and not-for-profit sectors lower the cost of payments acceptance and optimise the customer payments experience. Services include payments optimisation reviews, pricing comparisons, request for proposals, card scheme strategic merchant rate negotiations and consulting services.

- We leverage our independence, team of specialist consultants, deep payments industry experience, and proprietary tools, to cut through the complexity to deliver tangible results for our clients. We are proud of the industry solutions that we have developed to address many common challenges faced by our clients and partners in the sectors in which we operate.

- The firm’s client base includes financial institutions, card schemes, payments processors, retailers, not-for-profits, ATM deployers, international consulting firms, industry associations, and service providers to the payments industry.

Newgen a “Leader” in The Forrester Wave™ is the leading provider of unified digital transformation platform.

About Us

- Newgen a “Leader” in The Forrester Wave™ is the leading provider of unified digital transformation platform with native process automation, content services, and communication management capabilities.

- Diwakar Nigam co-founded Newgen in 1992. He is also a founding member of NASSCOM, India’s apex IT industry association, and was a member of NASSCOM’s Anti-Piracy Task Group. Prior to joining Newgen, he founded Softek and was associated with the company for 12 years.

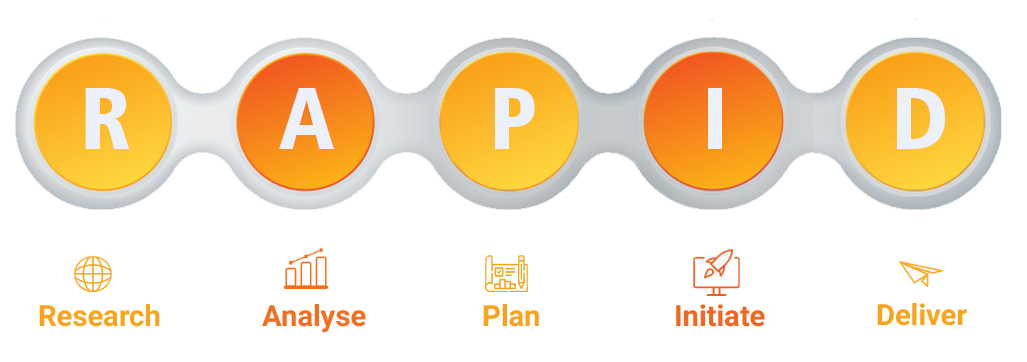

- IT Modernization, Rapid Digitization of Process-centric Applications ,Improved Customer and Employee Experience

- Contact us

- Present in the US, Canada, Caribbean, Europe, Middle East, Africa, India, Asia Pacific, Australia, and New Zealand

About The Company

Introduction To The Leadership Team

What Exactly Is The Problem Statement(s) To Focus On.

Contact And Website Details

Geographical Presence.

Our Solutions

- Our service-specific solutions like Online account opening, lending, trade finance, payments, policy administration, underwriting, claims, invoice processing and more built on NewgenONE low code digital transformation platform bridges enterprise-wide silos, builds a boundaryless workplace and can help you achieve any business goal

- Cloud and on-prem based platforms for process (BPM), content (ECM), and communication (CCM) automation that are scalable and extensible for secure access to processes and delivers deep insights/analytics

- Getting a proven platform, to support hundreds of complex business applications with full integration, extensibility, and low maintenance

- Simplifies a clutter of point applications and multiple user experiences and data repositories

- Recommended by consulting firms and industry analysts

- Dealing with one technology vendor for all process and content automation needs

- Quicker implementation – with a choice of GSI organization

Description Of Solutions

Description Of Products

USP Of The Solutions/Products/Descriptions .

KVB Global Capital is a financial services company that provides a suite of financial products worldwide.

About Us

- KVB Global Capital is a financial services company that specialises in providing a suite of financial products worldwide. Our products include global settlement and payment, corporate FX management, securities investment, wealth management, along with FinTech system and platform integration. We have established multiple licensed presences in Sydney and Melbourne Australia, Auckland New Zealand, Toronto Canada, Hong Kong, Taipei and Singapore. KVB is one of the few multinational non-banking financial institutions that licensed by regulators globally.

- Our mission is to be the leading provider of the most trusted, secure and innovative cross-border payments eco-system solutions in the markets we serve, which delivers long-term commercial benefits, based upon our client's key business requirements. The strategies evolved should be economical, efficient, durable, and flexible and allow the organizations to respond rapidly to both market and customer needs.

- Over the past 20+ years, KVB builds its services upon the core advantage of more than 120 currencies settlement capability around the world. Through our dedicated resources into financial technology over the years, we are able to create an eco-system that takes our customers to a one-stop financial services hub.

- We target different customers groups globally, such as multinational corporations with payments and collection needs, high-net worth individuals who are looking for competitive FX rates for investments, also other Financial Institutions that are interested in our while-labelled solutions to expand their business capabilities. Whether it is global settlement/payment, cross-border e-commerce, fin-tech, fund investment or global wealth management, we are able to provide top industry solution that is sound, secure, convenient and competitive.

- For more information, please visit www.kvbgc.com or contact KVB representatives at hk_gc@kvbgc.com.

iPiD is a fast-growing, venture-backed fintech start-up that was founded in late 2021. By a global team...

About Us

- iPiD is a fast-growing, venture-backed fintech start-up that was founded in late 2021.

- By a global team who have held senior roles at major payments and technology companies, including SWIFT and Thomson Reuters.

- Fraud and failed payments are a growing problem for the payments industry. Authorized push payment fraud, when consumers and businesses are tricked into sending money to criminals using either stolen or invented identities, is a particularly worrying trend.

- In addition to our HQ in Singapore, our global team has representatives in India, Belgium, Malaysia, Netherlands, South Africa, Spain, and Vietnam.

- Our Advisory Board includes senior figures from across the industry: Christian Sarafidis, Microsoft Chief Business Development Officer WWFSI; Kosta Peric, Deputy Director, Financial Services for the Poor, the Bill & Melinda Gates Foundation; and Nick Lewins, former banking Chief Technology Officer and now an advisor in data and AI, cloud technology and digital transformation.

- Reach out to IPiDhttps://ipid.tech/

- Making global payments simple, secure and seamless, IPiD provides solutions to validate payee bank accounts.

- iPiD’s flagship offering, Validate, tackles the escalating issue of fraud and failed payments within the payment industry by confirming payee names and bank account details.

- Validate provides reassurance to your customers that they are making a payment to a legitimate payee and the intended recipient.

- As well as reducing fraudulent transactions, Validate helps payment service providers to reduce the rising cost of failed payments due to data errors.

- Validate is especially effective in enhancing customer experience and combating authorized push payment (APP) fraud.

- By providing a reliable, state-of-the-art solution for fraud prevention and payment validation, iPiD is transforming the fintech arena and fostering trust and confidence within the global financial ecosystem.

- iPiD’s validation coverage now spands across India, Indonesia, Vietnam, the United States, Nepal, Nigeria, and Pakistan, with over 1.2 billion accounts, further solidifying iPiD’s commitment to enhance payment security and delivering exceptional customer experiences.

Our Solutions

We are a bunch of passionate designers, programmers & marketers covering anything that is needed for your digital presence...

- Team Variance is a versatile company that offers a range of professional services to businesses. We specialize in providing innovative solutions in various areas, including Market Research, Inbound Strategy, Sales Growth, Technology Solutions, software development, project management, online reputation management, B2B market automation, marketing data management.

- Excels in creating customized website solutions tailored to meet the specific needs of their clients. They leverage the latest technologies and industry best practices to develop robust and scalable software applications that enhance efficiency and productivity.

- Expertise in gathering, analyzing, and interpreting data to extract valuable insights that help businesses make informed decisions.

- Team Variance empowers clients with actionable intelligence in project management, ensuring smooth execution and successful completion of projects. Our skilled project managers employ effective methodologies and tools to oversee projects, manage resources, and achieve objectives within specified timeframes and budgets.

- Team Variance is the partner of choice for organizations seeking innovative solutions and a competitive edge.

- We are a bunch of passionate designers, programmers & marketers covering anything that is needed for your digital presence, whether its Web, Mobile, Digital PR or Filmmakers.

OFX grew from the idea that there had to be a better, fairer way to move money around the world.

- OFX grew from the idea that there had to be a better, fairer way to move money around the world.

- That was over 20 years ago, and since then, over 1 million customers have trusted OFX with transfers in 50+ currencies to over 170 countries.

- OFX don’t just offer great rates.They believe real help from real people counts. That’s why their clients get the best of both worlds – a seamless digital platform, combined with 24/7 phone access to currency experts.

- When it comes to moving money, peace of mind is important. OFX is monitored by over 50 regulators globally and work within a network of carefully selected banking partners.

- So whether you are sending money to friends and family abroad, or doing business across borders, OFX can get your money where it needs to go.

Fast, simple, secure.

Self-service internet-based solution via API, hosted, file-based processing.

Simple, smart, secure money movement

- Convera is one of the largest B2B cross-border payments companies in the world. Built on an expansive settlement network, our technology-led payment solutions are built with compliance at their core, to help you alleviate risk and get more value out of every transaction.

- From simple currency exchange, to sophisticated risk management strategies and API solutions, we make moving money so easy that any company in the world can grow with confidence.

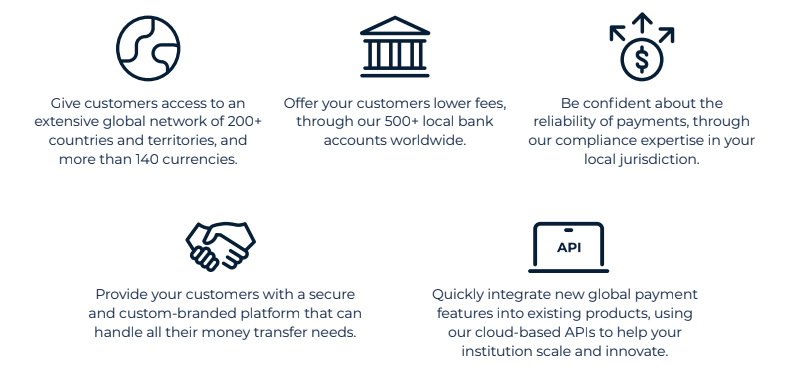

- Unlock new revenue streams easily by adding global payment capabilities to your product set. Convera helps over 1,800 banks, credit unions and FinTechs monetise their existing customer base and grow internationally. Our cross-border payment gateway offers a streamlined and cost-effective alternative to you and your customers to send international payments.

A trusted global network for financial institutions to tap into:

Future is Meta works with brands and corporates to develop their successful presence.

About Meta

- Future is Meta works with brands and corporates to develop their successful presence across different virtual worlds including Decentraland, The Sandbox, Roblox, VRChat and others. Leveraging the design expertise of its founding team members, including award-winning real-world architects, they develop unique virtual 3D spaces. Every project is created with the support of our in-house game developers, blockchain and NFT specialists. They provide the full breadth of services, including advisory, presence maintenance & monitoring services, games development, NFT production, smart contracts, token creation, training, and events organisation. Is this ok? Image and logo attached.